In the EU, since 2011 rules have applied regarding the supervision of the European wholesale energy markets, set out in the REMIT Regulation (Regulation on Wholesale Energy Market Integrity and Transparency). This regulation aims to prevent insider trading and market manipulation.

REMIT led a relatively dormant existence in its early years. European energy regulator ACER and the Netherlands Authority for Consumers and Markets (ACM) focused primarily on informing market participants. This changed from 2015 onwards, when the first fines were imposed in Europe on market participants that acted in breach of REMIT. Since then, a total of over €225 million in fines has been imposed in the EU. In the Netherlands, companies that infringe REMIT run the risk of an ACM fine of up to 10% of their turnover. The first fine in the Netherlands amounted to €150,000 and was imposed on PZEM in 2022 for failure to correctly disclose inside information.

REMIT has received renewed attention in recent years, partly due to the effects of the war in Ukraine on the wholesale markets. That was reason for ACM to announce in July 2022 that it would pay extra attention to insider trading on the wholesale energy markets. In November 2022, ACM announced that it had set up an international investigation group together with European energy regulator ACER and its fellow regulators from Germany and Austria, to tighten the supervision of the European gas market.

In February 2024, ACM announced that it had acted in response to signals about energy traders that may have engaged in market manipulation (spoofing). Most recently, in April 2024, the REMIT Regulation was significantly revised by Regulation 2024/1106 (REMIT II): a good reason to reflect on some of the key REMIT rules in this blog.

REMIT requirements in a nutshell

REMIT regulates at a European level the supervision of wholesale electricity and gas (energy) markets and has three core provisions:

- Article 3 prohibits insider trading. Inside information includes any concrete information about the wholesale energy market that is not public and that may affect market prices.

- Article 4 requires market participants to disclose inside information. For instance, market participants must publish information on the capacity and utilisation of the generation, storage, consumption and transmission facilities for electricity or natural gas, or LNG facilities.

- Article 5 prohibits manipulation of and attempts to manipulate the wholesale markets. This includes artificially inflating prices, providing incorrect information on the availability of electricity or gas, or placing false orders.

The new Article 5a also extends supervision to trading via or by algorithms. If algorithms are used, the market participant must report this to ACM. Effective systems and risk controls must furthermore be in place to prevent disruptions and incorrect trading orders. Information on trading strategies, trading parameters or limits, and compliance and risk controls must be kept for a minimum of five years so that ACM can retrieve it if necessary with a view to its supervision.

Furthermore, market participants must provide wholesale transaction information to ACER of their own accord (Article 8 REMIT and Implementing Regulation 1348/2014).

Which companies are affected by REMIT in the Netherlands?

REMIT has a broad scope. In principle, it applies to all EU trade in wholesale energy products (i.e. contracts and derivatives) for:

- the supply of electricity, gas (including LNG) or hydrogen;

- the transportation of electricity, gas or hydrogen; and

- the storage of electricity, gas or hydrogen (new since REMIT II).

REMIT applies regardless of the place or manner of trading. It also covers transactions through a multilateral trading platform (such as EPEX or ENDEX TTF) and bilateral over-the-counter (OTC) transactions, either directly or through traders.

The REMIT requirements apply to all ‘market participants’. This means any party that enters into a transaction – including by placing orders to trade – on one or more wholesale energy markets. The term therefore includes both suppliers and customers, and covers not only traditional producers of electricity and gas, but also:

- renewable producers, such as wind farms and solar farms;

- large consumers, such as data centres, greenhouse horticulture, industrial and chemical companies, and waste treatment plants, with a minimum capacity of 600 GWh per year;

- traders in energy and securities (‘persons professionally arranging transactions’); and

- transporters of gas or electricity, including storage systems and LNG terminals.

Dutch market participants are required to register with ACM as part of the supervision (Article 9 REMIT). European regulator ACER maintains an online register of all of the more than 16,000 registered market participants in the EU, roughly 800 of which are currently registered in the Netherlands.

Obligation to publish inside information: significant impact on the market price?

Market participants are required to publicly disclose in a timely and effective manner inside information relating to business activities or facilities that they (briefly put) operate. Inside information means:

“‘information of a precise nature which has not been made public, which relates, directly or indirectly, to one or more wholesale energy products and which, if it were made public, would be likely to significantly affect the prices of those wholesale energy products.”

The test is therefore whether the information may affect the price on the wholesale energy market. Whether that is the case depends on several factors, such as the size of the market, liquidity, the scope of the event, the supply and demand information already published, the timing of the event (day/time), and other circumstances, such as the weather, carbon or fuel prices. It is furthermore information which is required to be made public (see also Article 2(1) REMIT).

Information may relate to both the supply side (such as the capacity and utilisation of a power plant or wind farm) and the demand side of the market (such as a large industrial consumer), as well as storage facilities, transmission cables and LNG facilities. It includes scheduled and unscheduled unavailability of these facilities, for instance due to maintenance. ACM typically classifies scheduled maintenance as inside information if such maintenance is reasonably foreseeable. A change in announced maintenance may also constitute inside information, for instance if scheduled maintenance at a power plant unexpectedly needs to be extended by several hours.

The fact that limited generation (e.g. by a wind farm) is due to another party – such as the TSO – does not alter the operator’s obligation to disclose inside information.

Inside information must be published ‘as soon as possible’ and no later than one hour after the market participant obtains it, via what is known as an Inside Information Platform (IIP). Market participants must develop a clear compliance plan to achieve real-time or close to real-time publication.

In early 2023, ACM called on electricity producers to be more alert to the timely publication of ‘inside information’. According to ACM, inside information is still not always being published in a timely and proper manner. It warned that this year it will continue to closely monitor the correct publication of inside information – using the urgent market messages, among other things – and may impose fines or other sanctions if compliance does not structurally improve.

Smaller market participants must also publish inside information

The question is whether operators of smaller generation units can be exempted from the obligation to publish inside information, since REMIT does not set a lower limit. Indeed, under certain market conditions, even the unavailability of, for instance, a relatively small wind farm may significantly impact the market price. ACM, however, has issued guidance on this point that, in practice, means that smaller market events are treated more flexibly:

- first, according to ACM, most traders consider the unavailability of generation above the 50‑100 MW range to be important information, which would mean that it constitutes inside information; and

- second, ACM has indicated that it focuses its monitoring on the publication of unavailability above 100 MW.

These are not hard rules, however, and ACM leaves open the possibility of taking action against incorrect publication of non-availability below 100 MW.

Avoid inadvertent insider trading: arrange for functional and physical separation

Article 3 REMIT prohibits persons who possess inside information regarding a wholesale energy product from using it, including by directly or indirectly acquiring or disposing of, or trying to acquire or dispose of, the energy product in question for their own account or for the account of a third party. They are also prohibited from disclosing this information to a third party, unless that is done in the normal course of their work, profession or duties. It is also prohibited to recommend or induce a third party to acquire or dispose of the energy product in question on the basis of inside information.

The prohibition on insider trading also affects the internal organisation of companies in the energy sector that operate a plant or may otherwise possess inside information while also trading on the energy market. The latter may be the case, for instance, if a large industrial customer’s plant temporarily shuts down, which may have an effect on the energy price due to its size, and that party also operates on the energy market as a buyer.

According to ACM, inadvertent insider trading can be prevented only by keeping internal communication processes about generation clearly separated from the processes related to trading on the wholesale market. This can be done, for instance, by clear separation of functions and physical separation (i.e. in separate rooms) between traders and dispatchers. According to ACM, not every market participant has regulated this properly. ACM has announced that it will actively monitor this.

Market manipulation

Article 5 REMIT prohibits manipulation of energy markets. This first of all means entering into a transaction or giving, changing or withdrawing orders to trade or any other act related to a wholesale product:

- that gives or is likely to give false or misleading signals regarding supply, demand or price;

- in which one or more persons conspire to maintain the price at an artificial level (unless the motives for the transaction are justified and in accordance with accepted market practices); or

- employing an improper device or other form of deception or contrivance that gives a false or misleading impression about supply, demand or price.

ACER distinguishes several types of market manipulation in the REMIT Guidance, a few of which we address below:

- Wash trades relate to fictitious trading in which a trader in fact sells the wholesale product to itself. These may be transactions within or between the same or affiliated legal entities. They may also involve a transaction in which wholesale products are sold from A to B and traders agree to sell back under the same market conditions. This (artificially) increases the trading volume while not actually changing economic interests or the market risk.

- In spoofing and layering, a trader uses visible, non-genuine orders to mislead other traders as to the true levels of supply and demand in the market.

- Spofing involves placing one or more bogus offers at one price level on the buy or sell side in order to ultimately make one or more transactions on one side. For instance, a seller may place an anonymous bogus offer on the buy side so that the genuinely interested buyer bids more than the seller’s anonymous bogus offer.

- Layering invlves making several bogus offers at different price levels on the buy or sell side in order to ultimately make one or more transactions on the other side. Layering occurs when a trader places multiple orders that he does not intend to execute. These fake orders may mislead other market participants by giving the false impression of high buying or selling pressure in the order book.

Second, market manipulation refers to the dissemination of information – through the media or other channels – that gives false or misleading signals regarding the supply, demand or price of a wholesale product. This also includes the dissemination of rumours and false or misleading messages, which the person disseminating the information knew or should have known were false or misleading. REMIT II adds that passing on or providing false and misleading information or data in connection with a benchmark may also constitute market manipulation.

Increasingly high fines for REMIT violations

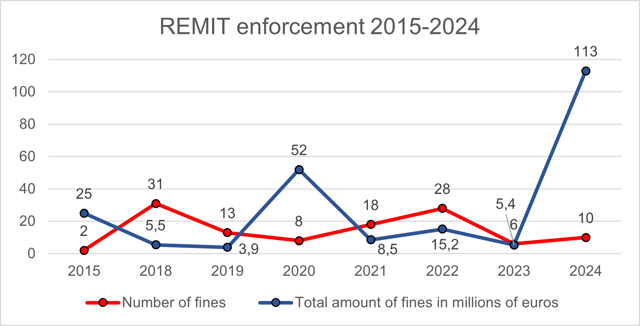

The supervision and enforcement of REMIT is a task of national regulators: in the Netherlands that is ACM. The enforcement in Europe has been slow to take off, with 2015 seeing the first two fines imposed by authorities in Estonia and Spain. The fines were immediately significant, however: €25 million in total.

The picture changes as from 2018. A total of 31 fines were imposed by national authorities in that year, according to ACER. A total of 62 more fines would follow in the subsequent years, 28 of them in 2022. To date, a total of over €225 million in fines has been imposed by European regulators for REMIT violations. This amount could have been even higher: at the end of 2022, 350 potential REMIT violations were pending in the EU. In 2023, that number increased to almost 380 potential violations.

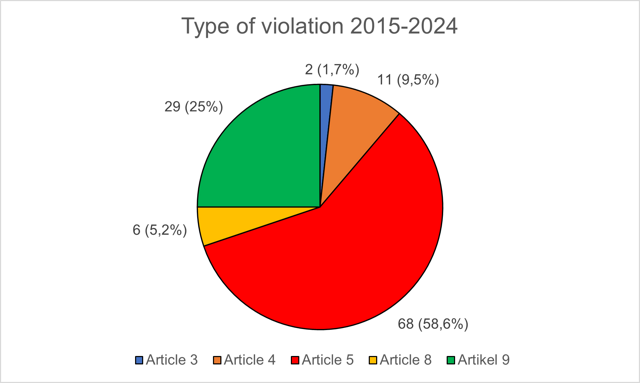

Considering the type of violation, most of the fines (68 out of 116) were imposed for manipulation of and attempts to manipulate the market (Article 5 REMIT). This is also the largest investigations category within ACM. By February 2024, ACM was still conducting 19 ongoing investigations into market manipulation, compared to four investigations into insider trading and incorrect publication of inside information.

Intensified supervision by ACM

After settling earlier investigations with a warning, ACM imposed a €150,000 fine on Dutch energy producer, supplier and trader PZEM for the first time in June 2022. PZEM owns power plants, including the Sloe Centrale with a maximum capacity of 870 MW. PZEM published knowledge of the increase or reduction of the Sloe power plant’s generation capacity only at the last minute, despite being aware of the impending restriction for some time already. PZEM therefore provided incomplete information about the unavailability, which affected trading decisions regarding wholesale energy products. PZEM therefore acted in violation of Article 4 REMIT, according to ACM.

ACM continuously investigates signals about possible violations. These signals may come from Suspicious Transaction Reports (by e.g. trading platforms and market participants), media reports, and contacts with external parties. ACM also receives reports from ACER, based on transaction data on the Dutch market. Article 15 REMIT obligates trading venues to report signals about suspicious trading to ACM (and ACER) immediately, or in any event within four weeks at the latest.

ACM may initiate a formal investigation and enforcement process or opt for so-called short interventions in response to such signals. As part of its investigation, ACM may review or remove all forms of evidence during a dawn raid, such as emails, WhatsApp messages and recorded telephone conversations, for instance between traders or with a dispatcher.

Short interventions are cases that involve, for instance, no or very limited impact on the market, or in which a quick and informal intervention can put an end to the suspicious behaviour more quickly and effectively than a formal investigation. This may take the form of a so-called disciplinary meeting, a further explanation of the rules, a warning, and/or obtaining an undertaking from the market participant that the behaviour will no longer occur.

The team at Maverick Advocaten specialises in economic regulation and has extensive experience in regulated markets and enforcement by ACM. Please contact Cyriel Ruers if you have any questions about REMIT compliance or ACM’s supervision of the energy market.

Follow Maverick Advocaten on LinkedIn